Moving Averages in Techincal Analysis.

Moving averages are crucial tools in the realm of technical analysis. These indicators play a fundamental role in assessing trends and making informed trading decisions.

What Is a Moving Average?

A moving average is a statistical calculation that smoothes out price data over a specified time period. It is used to identify trends, support, and resistance levels in financial markets. The calculation involves taking the average of a set of past prices, often closing prices, over a defined period. The result is a line that moves along with the price chart, providing traders with valuable insights.

Types of Moving Averages:

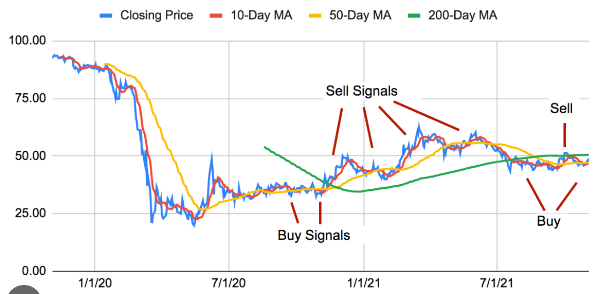

There are two primary types of moving averages: the simple moving average (SMA) and the exponential moving average (EMA). The SMA gives equal weight to all prices in the calculation, while the EMA assigns greater importance to recent prices, making it more responsive to current market conditions.

How Moving Average Helps Traders:

- Trend Identification: They help traders identify the direction of a trend. When the price is above a moving average, it may indicate an uptrend, and when below, a downtrend.

- Support and Resistance: They can act as support or resistance levels. Prices often bounce off a moving average, making it a critical level for traders.

- Crossovers: The crossover of short-term and long-term moving average can signal potential buying or selling opportunities.

- Volatility Assessment: The spacing between the price and moving average lines can help assess market volatility.

- Timing Entries and Exits: Traders often use moving averages to time their entries and exits in trades, aiming to buy low and sell high.

Selecting the Right Moving Average:

Choosing the appropriate time period for a moving average depends on the trader’s strategy and the market object of anaysis. Shorter time periods, such as the 50-day or 20-day, are used for short-term trading, while longer periods, like the 200-day, are employed for longer-term trends.

In summary, moving averages are a vital tool in technical analysis. They assist traders in trend identification, support, and resistance levels, timing entries and exits, and assessing market volatility. Understanding the different types of moving averages and their applications is crucial for successful trading.